Power Semiconductors for Automotive industry

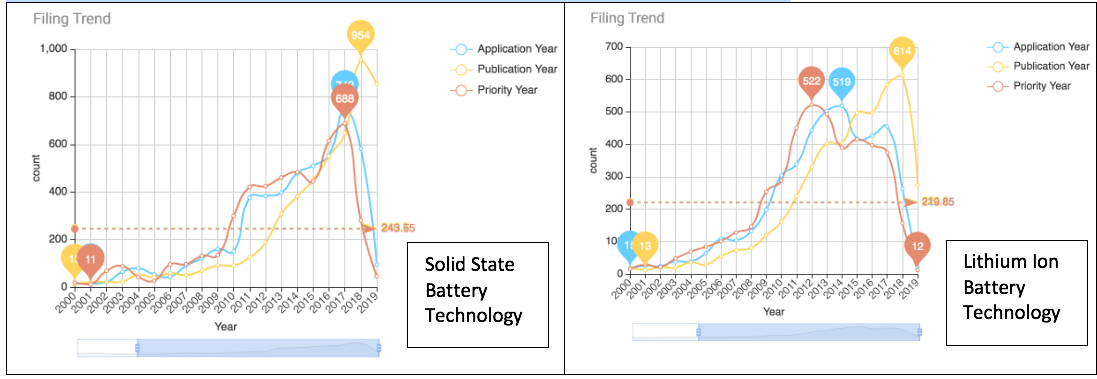

The automotive industry is going through a major change with more than 270 ambitious startups revving up the electric vehicle industry. There were more than 43 confirmed model launches in 2019 – 25 battery EVs (BEVs) and 18 plug-in hybrid EVs (PHEVs). Electric mobility options are becoming more prominent in ride-sharing and micro-mobility solutions. In US, California continues to set the national pace on EV policies although there are looming uncertainties over federal EV incentives. 2019 will be the first year when the average battery range for all EV models exceeds 200 miles. Battery technology continues to be the limiting factor for EV driving range and also the focus of innovation to enable wider EV adoption. Dolcera’s analytic tool PCS shows an increase in IP filing trend in the field of solid state battery (Table 1) as heavy weight and limited energy density of lithium-ion batteries are the reason behind driving range anxiety.

Table 1 Patent Filing trends – Comparison on PCS (AI enabled Analytics tool from Dolcera)

An electric vehicle has three major components – Electric motor, motor controller and battery. The motor controller is the electronics package that operates between batteries and motor to control electric vehicle’s speed and acceleration. While AC motors are more common with less mechanical wear and tear, they require more sophisticated motor controller. On the other hand, DC motors have a simpler controller making DC motor/controller combination comparatively cheaper. However DC motors are less popular in automobiles due to high wear and tear. With the advent of advanced power semiconductors in controllers and improved AC motor efficiency, large number of electric vehicles are using AC motor/controller systems.

Power inverters are the major electronic component inside motor controller. As the battery generates DC power, power inverters are used to invert High Voltage DC current to AC current for motors; they also convert AC current to DC current for charging the battery pack during regenerative braking. As a result, the driving range of vehicle is directly related to efficiency of inverter circuit.

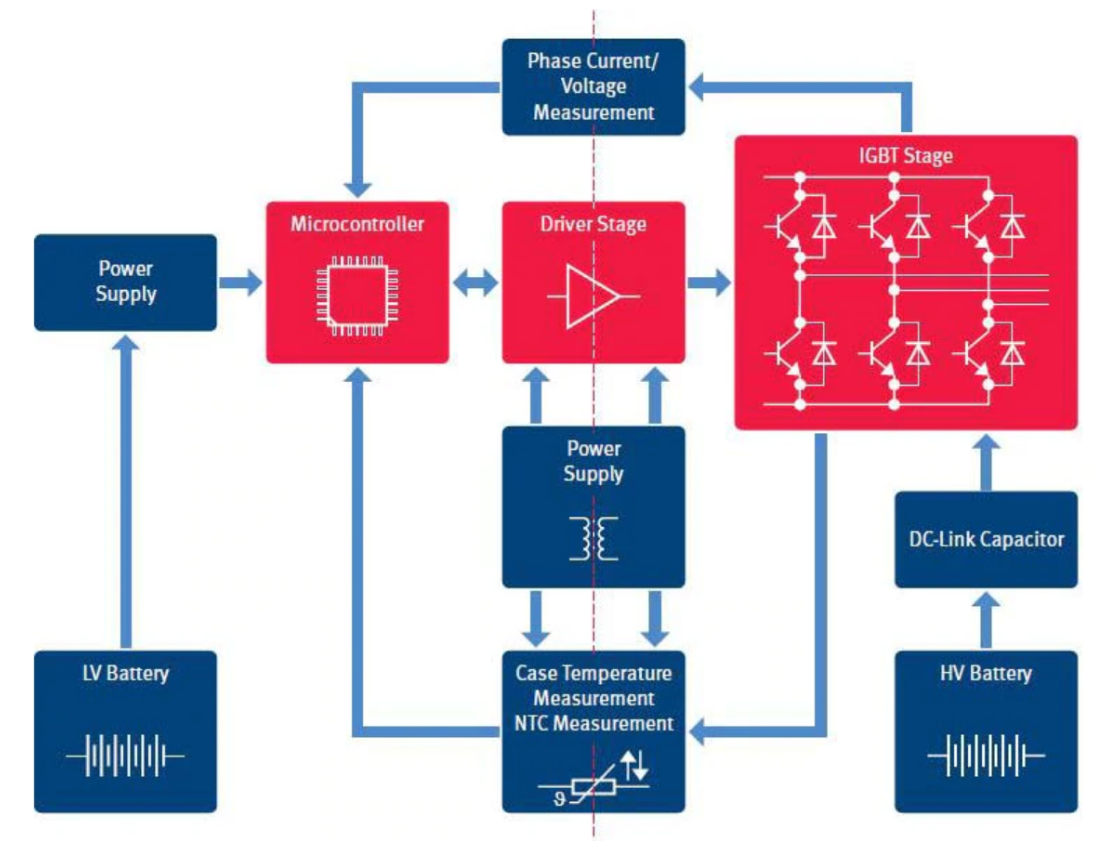

Figure 1 Block diagram of power inverter (Source: Infineon Technologies)

In Figure 1, the Insulated Gate Bipolar Transistors (IGBT) are high voltage, high current switch that directly controls current supplied to traction motor. More efficient the IGBT, less power is lost to wasted heat leading to better mileage. Alternatives to IGBT are Silicon Carbide (SiC) based power MOSFETs that have advantages like high breakdown voltage, low on-resistance, fast switching speed, high temperature capability and high power density. SiC is a wide bandgap semiconductor that allow power devices to operate at higher voltages, higher temperatures and higher frequencies. While Silicon has a breakdown electric field of 0.3MV/cm, SiC can withstand up to 2.8MV/cm. As SiC has internal resistance 100 times smaller than silicon, SiC based ICs can handle 100 times larger current without increasing size of passive components. Some of the key players of SiC devices are Wolfspeed, Apex Microtechnology, Texas instruments, IXYS, Broadcom and ON Semiconductor.

SiC devices are already commercialized by automotive sector and many corporations are investing in continuous research including alternative packing methods and performance improvement. Although SiC material was conventionally used as abrasive, heating element and cladding for nuclear industry; however it has some unique challenges while used as a semiconductor.

- Main goal of SiC MOSFET is to replace IGBT, but the driving requirement of SiC is very different. Most electronic device require symmetric rails (like +5V to -5V) but SiC devices require asymmetric rails like -1V to -20V. This needs specialized batteries with three connections (+V, 0V and -V).

- Packaging methods to dissipate heat generated is yet to match the superb thermal properties of SiC.

- Parasitics related to current packages become prominent in high frequencies and nullify the high frequency advantages of SiC.

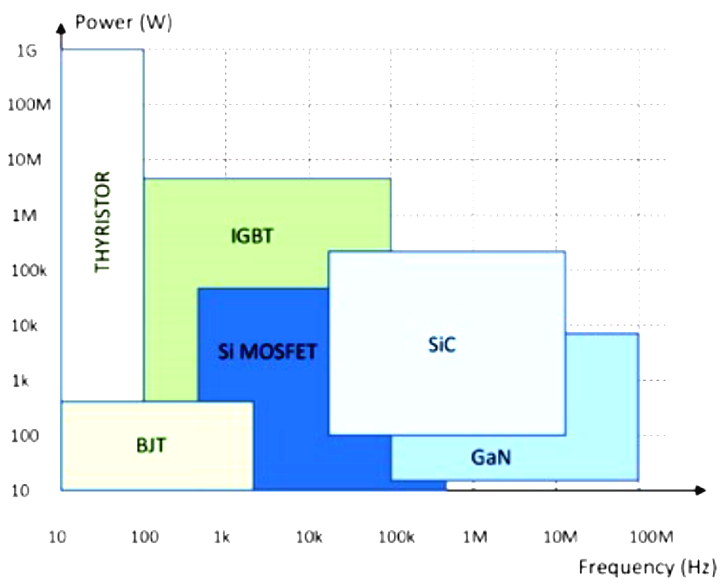

Gallium Nitride (GaN) is another compound semiconductor in contest to replace Silicon from power electronic applications. Compared to silicon based IGBT, GaN’s higher electron mobility enables smaller size devices for a given on-resistance and breakdown voltage. GaN is theoretically capable of higher switching speed than SiC or Si due to higher electron mobility but it struggles to compete with the current lower cost and proven robustness of more mature SiC. As of today, SiC trench cascodes have natural advantage over GaN and Si-MOSFETs and SiC-MOSFETs. Fig.2 below shows a view of possible future trend for power semiconductor technology adoption across different power range and operating frequency.

Figure 2 Future trend for power semiconductor techonologies [Source: UnitedSiC]

While Ford, Toyota, Daimler, Volkswagen, Renault, Nissan, Mitsubishi and Hyundai are investing hundreds of millions of dollars in solid-state battery research, EV pioneer Tesla remains an outlier and still bets heavily on lithium-ion technology. IP asset optimization will be a unique challenge for all those market players as electric vehicles and autonomous driving continue to be the key drivers of future economic growth. Services provided by IP consulting firms like Dolcera can enable streamlining of the complete innovation process across all domains and assist businesses in balanced allocation of R&D resources for long-term growth.

PCS is Dolcera’s flagship patent analytics platform. With a corpus of over 110 million worldwide patents updated daily, PCS provides answers to every patent question in detail and blindingly fast.

For more queries, feel free to visit us at http://dolcera.com/

中文

中文