Innovative personal finance products

From DolceraWiki

Contents

Brief

- Identify innovative personal finance products in various countries

- Personal finance products such as loans, credit cards etc. customized and productized in ways to appeal to local markets

Approach

- Trend analysis

- Demographic trends

- Market trends

- Technology trends

- Regional trends

- Sociocultural trends

- Internet and communication trends

- Market analysis

- Quantifying above trends

- Estimating size of markets

- Identify needs based on trends

- Survey of existing products

- Analyze strengths, weaknesses of existing products

- Identify new products

- New product ideas

- Invent new products based on trends

- Qualify new product ideas

- Quantify market size for new ideas

- Identify implementation strategies for new ideas

India: Demographic trends

- Asia is exploding with money

- China, India etc. have a voracious appetite for credit

- People there are very worried about weddings, especially daughters' weddings can be extremely expensive

300 million strong middle class

- The Indian middle class is 300 million people with a purchasing power of US families with $15,000-$35,000 in annual income

- Huge appetite for two-wheelers, telephones and cars

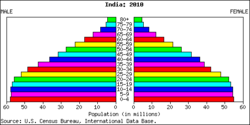

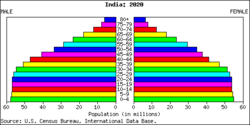

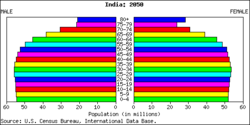

Demographic dividend

- With one of the youngest populations in the world, India is ready to reap the demographic dividend of a large, young workforce over the next several decades.

Education

- 50% of India's population is below the age of 25 and 2/3rd of the population is below the age of 35

Employment

- In some areas of knowledge services, salaries in India are coming close to American salaries in Purchase-Power Parity (PPP) terms

India: Financial trends

Overall economy

| GDP growth in FY 2005-06 | 8.1% |

|---|---|

| GDP growth predicted for FY 2006-07 | 7.5% |

| Savings as percentage of GDP | 29.1% in FY 2004 and 25.9% in FY 2005 |

| Net income of Sensex 30 companies | 36.4% in FY 2005-06 |

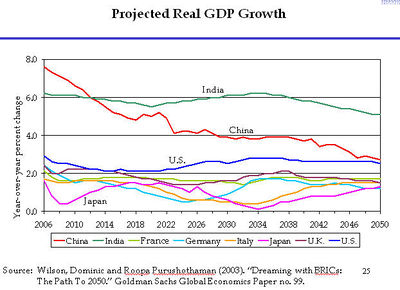

- GDP growth is projected at 6% and higher for the coming decades, making India the fastest-growing large economy in the world

Foreign Direct Investments

- Foreign Direct Investment inflows are rapidly growing in India and have reportedly reached an all-time high of $7 billion last year, doubling from just 6 years ago

Credit

- Booming economy with a growing middle class

- Access to credit is relatively new

| "There is a great investment opportunity opening up in India. We term this investment area as the 'lifestyle segment.'" - Nilesh Shah, President, Kotak Mahindra Asset Management Co. Ltd. |

|---|

- Demand for consumer goods is growing rapidly

Rural credit

- Lack of access to savings mechanisms and credit is one of the biggest challenges for villagers in India.

- According to a World Bank study, in Andhra Pradesh, 59% of rural households lack access to deposit accounts and 79% don’t have borrowing facility from the organised financial sector. Bankers too complain that though the rural potential is huge, they don’t have enough knowledge about the rural customer.

- Innovative concepts, such as a mobile ATM machine are being tried out at the moment.

Microfinance

- 1.4 million microfinance groups in India

- Over 20 million members for microfinance groups

- According to one estimate, 30 million non-agricultural enterprises and 50 million landless households in India collectively need approximately $30 billion credit annually

- Microfinance is growing in South India, which contrasts with the stagnation in Eastern, Central and North Eastern India

- Downside: Microfinance involves very high transaction costs given the small amounts of money involved for each loan, which necessitates high transaction costs

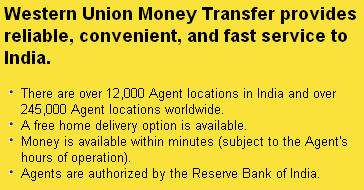

Remittances

Hawala

- An illegal system of payment, hawala remains popular as a way of remitting money

Payments

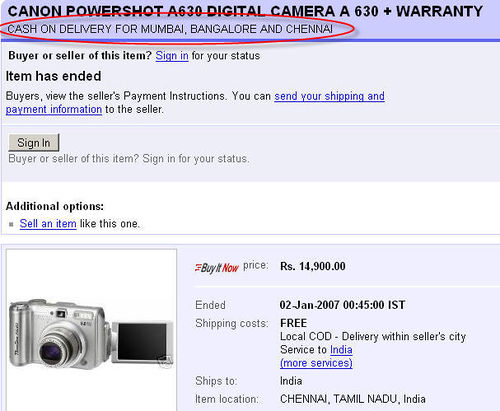

- Cash-on-delivery (COD) remains one of the preferred methods of payment

- Fraud is a major problem, e.g. loans on homes are based on higher valuations by the appraiser

- There is no credit rating system and the judicial system does not allow companies to easily recover their money from the borrowers

- A high amount of undisclosed income

- Hawala

- Cash-on-delivery (COD)

- Airlines, railways and others are now selling tickets online and it is cheaper than buying through an agent or from the airline. You need a credit card to buy these online.

- Pension funds are still big in India. Not clear if India will go the US route of defined contribution plan (as opposed to defined benefit plan)

India: Customer service

- If you want to open an account of if you want a loan, someone comes to your house from the bank to get the papers to you

- If you want to exchange currency, someone comes to your house for that too

India: Sociocultural trends

- Movies get financing from the underworld and other unsavory sources

Dowry

- The custom of dowry is well-entrenched in Indian society and puts extreme financial pressure on brides and their families

- An average of one dowry death is reported every 77 minutes according to the National Crime Record Bureau

Anecdotes

- There was this article about citibank or someone hiring goons to get an executive woman to pay her credit card bill. She defaulted because she was travelling. She created a big stinker.

- A grocery store in India figured out that its cost of capital was much higher than what their customers were earning in a savings account. They came up with a scheme whereby consumers could give them a deposit and they would give them coupons to shop in their store. The effective interest rate that the consumer was getting was higher than what a bank offered them, however the interest rate was however lower than the cost of capital for the grocery store and they got loyal customers.

Needs

- Non-traditional ways of evaluating credit worthiness

- How to give credit to developing markets using different approaches than developed markets

- Short-term loans

- High transaction fees but low interest

- Non-revolving credit card

- Need money to buy groceries this week, pay back next week or end of month (Payday loan?)

- Programs to help fund big events such as daughter's weddings

- Financial advisory services to high net worth individuals

- Financing for movies

- Simplified COD

- Escrow services

- Loans for individuals with lower credit scores (people who don't appear very credit worthy on paper)

- A clearing house that could collect cash from people's houses or stores for airline/railways transactions - that would be convenient for people without credit cards