India

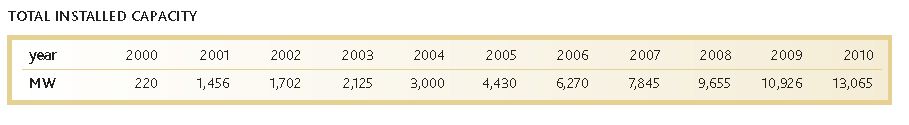

India had a record year for new wind energy installations in

2010, with 2,139 MW of new capacity added to reach a total

of 13,065 MW at the end of the year. Renewable energy is

now 10.9% of installed capacity, contributing about 4.13% to

the electricity generation mix, and wind power accounts for

70% of this installed capacity. Currently the wind power

potential estimated by the Centre for Wind Energy

Technology (C-WET) is 49.1 GW, but the estimations of

various industry associations and the World Institute for

Sustainable Energy (WISE) and wind power producers are

more optimistic, citing a potential in the range of 65-

100 GW.

Historically, actual power generation capacity additions in

the conventional power sector in India been fallen

significantly short of government targets. For the renewable

energy sector, the opposite has been true, and it has shown a

tendency towards exceeding the targets set in the five-year

plans. This is largely due to the booming wind power sector.

Given that renewable energy was about 2% of the energy

mix in 1995, this growth is a significant achievement even in

comparison with most developed countries. This was mainly

spurred by a range of regulatory and policy support measures

for renewable energy development that were introduced

through legislation and market based instruments over the

past decade.

The states with highest wind power concentration are Tamil

Nadu, Maharashtra, Gujarat, Rajasthan, Karnataka, Madhya

Pradesh and Andhra Pradesh.

Main market developments in 2010

Today the Indian market is emerging as one of the major

manufacturing hubs for wind turbines in Asia. Currently,

seventeen manufacturers have an annual production capacity

of 7,500 MW. According to the WISE, the annual wind turbine

manufacturing capacity in India is likely to exceed

17,000 MW by 2013.

The Indian market is expanding with the leading wind

companies like Suzlon, Vestas, Enercon, RRB Energy and GE

now being joined by new entrants like Gamesa, Siemens, and

WinWinD, all vying for a greater market share. Suzlon, however,

is still the market leader with a market share of over 50%.

The Indian wind industry has not been significantly affected

by the financial and economic crises. Even in the face of a

global slowdown, the Indian annual wind power market has

grown by almost 68%. However, it needs to be pointed out

that the strong growth in 2010 might have been stimulated

by developers taking advantage of the accelerated

depreciation before this option is phased out.

Policy support for wind power in India

Since the 2003 Electricity Act, the wind sector has registered

a compound annual growth rate of about 29.5%. The central

government policies have provided policy support for both

foreign and local investment in renewable energy

technologies. The key financial incentives for spurring wind

power development have been the possibility to claim

accelerated depreciation of up to 80% of the project cost

within the first year of operation and the income tax holiday

on all earnings generated from the project for ten

consecutive assessment years.

In December 2009 the Ministry for New and Renewable

Energy (MNRE) approved a Generation Based Incentive (GBI)

scheme for wind power projects, which stipulated that an

incentive tariff of Rs 0.50/kWh (EUR 0.8 cents/USD 1.1 cents)

would be given to eligible projects for a (maximum) period of

ten years. This scheme is currently valid for wind farms

installed before 31 March 2012. However, the GBI and the

accelerated depreciation are mutually exclusive and a

developer can only claim concessions under one of them for the same project. Although the projected financial outlay for

this scheme under the 11th Plan Period (2007-2012) is

Rs 3.8 billion (EUR 61 million/USD 84 million), the uptake of

the GBI has been slow due to the fact that at the current rate

it is still less financially attractive than accelerated

depreciation.

Currently 18 of the 25 State Electricity Regulatory

Commissions (SERCs) have issued feed-in tariffs for wind

power. Around 17 SERCs have also specified state-wide

Renewable Purchase Obligations (RPOs). Both of these

measures have helped to create long-term policy certainty

and investor confidence, which have had a positive impact on

the wind energy capacity additions in those states.

Support framework for wind energy

There has been a noticeable shift in Indian politics since the

adoption of the Electricity Act in 2003 towards supporting

research, development and innovation in the country’s

renewable energy sector. In 2010, the Indian government

clearly recognised the role that renewable energy can play in

reducing dependence on fossil fuels and combating climate

change, and introduced a tax (“cess”) of Rs.50 (~USD1.0) on

every metric ton of coal produced or imported into India. This

money will be used to contribute to a new Clean Energy Fund.

In addition, the MNRE announced its intention to establish a

Green Bank by leveraging the Rs 25 billion (EUR 400 million /

USD 500 million) expected to be raised through the national

Clean Energy Fund annually. The new entity would likely work

in tandem with the Indian Renewable Energy Development

Agency (IREDA), a government-owned non-banking financial

company.

In keeping with the recommendations of the National Action

Plan on Climate Change (NAPCC) the MNRE and the Central

Electricity Regulatory Commission (CERC) have evolved a

framework for implementation of the Renewable Energy

Certificate (REC) Mechanism for India.1 This is likely to give

renewable energy development a further push in the coming

years, as it will enable those states that do not meet their

RPOs through renewable energy installations to fill the gap

through purchasing RECs.

Obstacles for wind energy development

With the introduction of the Direct Tax Code2, the

government aims to modernize existing income tax laws.

Starting from the fiscal year 2011-12, accelerated

depreciation, the key instrument for boosting wind power

development in India, may no longer be available.

Another limitation to wind power growth in India is

inadequate grid infrastructure, especially in those states with

significant wind potential, which are already struggling to

integrate the large amounts of wind electricity produced. As

a result, the distribution utilities are hesitant to accept more

wind power. This makes it imperative for CERC and SERCs to

take immediate steps toward improved power evacuation

system planning and providing better interface between

regional grids. The announcement of India’s Smart Grid Task

Force by the Ministry of Power is a welcome first step in this

direction.